Not known Facts About Bank Of The Philippine Islands

Wiki Article

Things about Bank Bar

Table of ContentsUnknown Facts About Bank Account NumberThe Facts About Bankrupt UncoveredThe Greatest Guide To Bank At CityRumored Buzz on Bank At FirstLittle Known Questions About Bank At First.

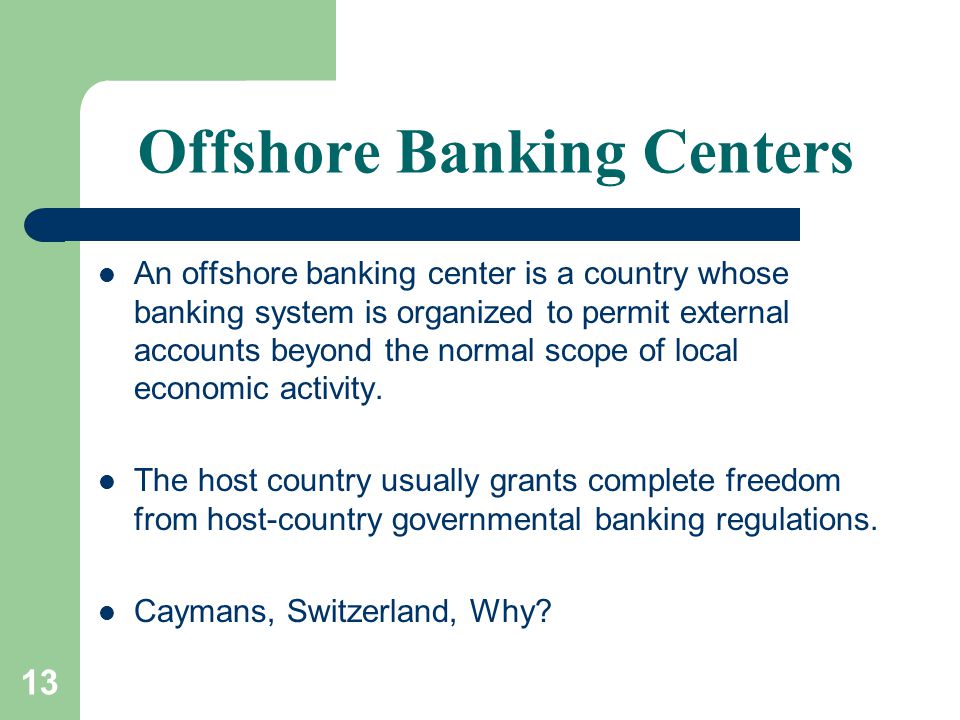

What Is an Offshore Financial Unit (OBU)? An overseas banking device (OBU) is a bank shell branch, situated in another global financial center. As an example, a London-based financial institution with a branch situated in Delhi. Offshore banking devices make finances in the Eurocurrency market when they accept down payments from foreign financial institutions as well as other OBUs.

OBUs are concentrated in the Bahamas, the Cayman Islands, Hong Kong, Panama, as well as Singapore. In many cases, overseas banking systems may be branches of local and/or nonresident banks; while in other instances an OBU may be an independent facility. In the initial case, the OBU is within the direct control of a moms and dad business; in the second, although an OBU might take the name of the parent company, the entity's administration and accounts are separate.

Some Known Details About Bank At City

Similar to various other OBUs, IBF down payments are limited to non-U - bank of commerce.S applicants.OFCs frequently likewise impose little or no company tax obligation and/or individual income and also high straight taxes such as responsibility, making the price of living high. With around the world increasing steps on CFT (fighting the funding of terrorism) and also AML (anti-money laundering) conformity, the overseas banking field in the majority of jurisdictions was subject to altering guidelines.

Bank Of Makati Things To Know Before You Get This

OFCs are stated to have 1. A group of lobbyists mention that 13-20 trillion is held in offshore accounts yet the real figure can be a lot greater when taking right into account Chinese, Russian and US implementation of capital worldwide.Similar to a criminal making use of a budget recognized and also confiscated as earnings of criminal offense, it would be counterproductive for any individual to hold assets extra. A lot of the capital flowing with cars in the OFCs is aggregated investment resources from pension funds, institutional as well as exclusive financiers which has actually to be released in market around the Globe.

Offshore financial institutions offer access to politically as well as economically secure jurisdictions. It is also the instance that onshore banks use the very same advantages in terms of stability.

Some Known Factual Statements About Bankruptcy

Advocates of overseas banking often identify government regulation as a form of tax on residential financial institutions, minimizing rates of interest on deposits. Nevertheless, this is rarely real currently; most overseas countries offer extremely comparable passion prices to those that are provided onshore as well as the offshore financial institutions currently have substantial conformity requirements ensuring groups of customers (those from the USA or from higher risk account countries) unsightly for different factors.In 2009, The Isle of Man authorities were eager to aim out that 90% of the complaintants were paid, although this only referred to the number of people that had actually received money from their depositor compensation system and also More about the author not the amount of cash refunded.

Only offshore centres such as the Isle of Male have actually refused to make up depositors 100% of their funds complying with financial institution collapses. Onshore depositors have actually been refunded in complete, regardless of what the settlement limit of that country has specified. Therefore, banking offshore is historically riskier than banking onshore.

The smart Trick of Bank At City That Nobody is Discussing

However, overseas banking is a legitimate financial solution utilized by many expatriate and global workers. Offshore territories can be remote, and for that reason expensive to see, so physical access can be difficult. [] This trouble has actually been reduced to a significant level with the arrival as well as awareness of on-line banking as an useful system. [] Offshore private banking is usually more accessible to those with higher earnings, due to the expenses of establishing and preserving offshore accounts.

24). A current [] Area Lawsuit in the 10th Circuit may have considerably broadened the meaning bank foreclosed properties 2021 of "passion in" as well as "various other Authority". [] Offshore savings account are occasionally touted as the option to every have a peek at these guys lawful, financial, and possession defense strategy, but the advantages are frequently exaggerated as in the more popular territories, the degree of Know Your Customer evidence required underplayed. [] European crackdown [modify] In their efforts to stamp down on cross border passion payments EU federal governments accepted the introduction of the Cost savings Tax Obligation Directive in the type of the European Union holding back tax obligation in July 2005.

Report this wiki page